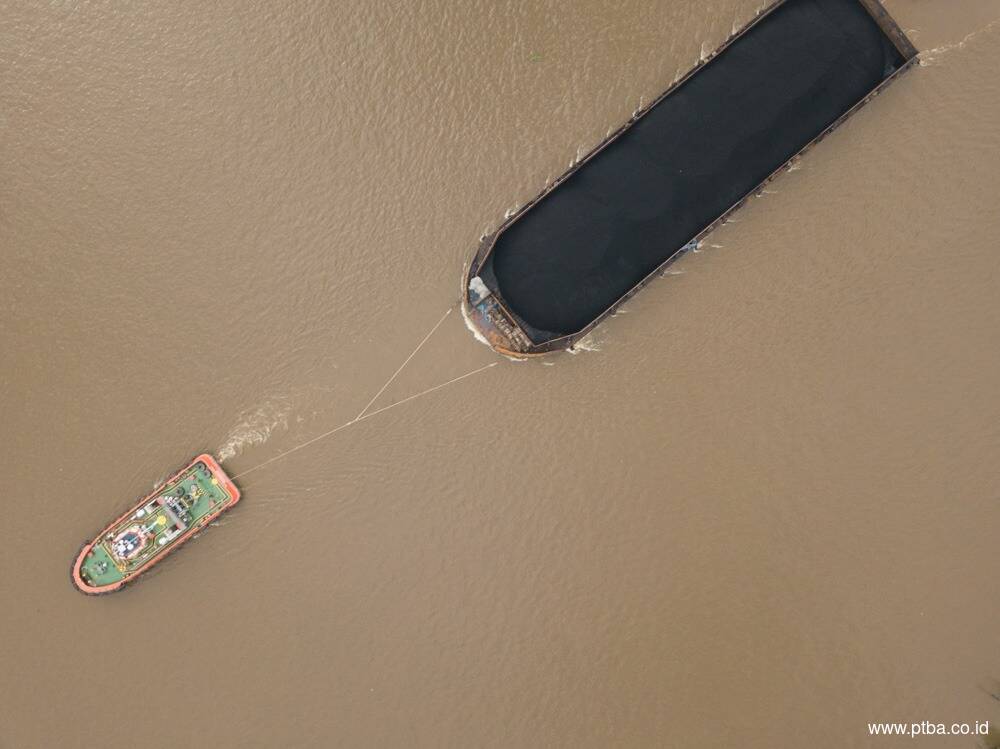

BUKIT ASAM will increase production following the current trend of the increasing coal prices. The target: domestic market.

Bukit Asam takes advantage of the momentum of the increasing global coal prices. Having increased its production capacity, this state-owned company will strengthen coal sales in the domestic and export markets. Based on Bloomberg data, the price of ICE Newcastle coal for the July 2021 contract was at the level of US$99.4 per ton in trading on June 14, 2021. In fact, the coal price had penetrated the level of US$102.55 per ton the day before.

Bukit Asam Corporate Secretary Apollonius Andwie C. said that the increase in coal prices accompanied by the addition of the national coal production quota by the government was mainly an opportunity for Bukit Asam to increase its production. Bukit Asam also got the opportunity to increase its coal production again for the rest of this year. "Currently we are exploring with the Ministry of Energy and Mineral Resources to get bigger opportunities," said Pollo.

For your information, the Ministry of Energy and Mineral Resources had raised the national coal production target in 2021 from 550 million tons to 625 million tons. Bukit Asam had targeted coal production of 29.5 million tons this year, and then increased it to 30 million tons. For the record, in the first three months of 2021, Bukit Asam was able to produce 4.5 million tons of coal with sales of 5.9 million tons.

Bukit Asam management said that sales started to show a positive signal amid the national economic recovery. The domestic market was still the main contributor to PTBA's coal sales. PTBA's coal sales in the domestic market also strengthened by the alumina smelter in Bintan, to which Bukit Asam supply the coal.

As of the first quarter of 2021, Bukit Asam's revenue value from domestic coal sales reached IDR2.59 trillion, the highest compared to the company's coal sales to other countries. So far, the electricity sector had contributed greatly to PTBA's domestic coal sales. This was evident as PTBA's coal sales to PT Perusahaan Listrik Negara (Persero) amounted to IDR1.05 trillion and PT Indonesia Power amounted to IDR880.25 billion in the first quarter of 2021. These two companies contributed more than 10% of PTBA's total revenue.

Pollo also said that Bukit Asam's export sales were also stable. This was considering the demand for coal exports to various countries is already fully booked. "One of our expansion markets is the Philippines," said Pollo. Besides the Philippines, Bukit Asam also exports coal to China, India, Taiwan, Japan, Malaysia, Hong Kong, Vietnam, and others.

Not only producing and selling coal, Bukit Asam also focuses on developing coal gasification projects into Dimethyl Ether (DME) together with PT Pertamina (Persero) and Air Products & Chemicals, Inc (APCI). Last Tuesday, May 11, 2021, Bukit Asam, Pertamina and APCI signed the Amendment to the DME Development Cooperation Agreement which took place in Jakarta and Los Angeles, United States.

Pollo said that Bukit Asam was following up on the signed agreement to be finalized. After that, Bukit Asam will start the pre-construction stage for the project, which is located in Tanjung Enim, South Sumatra. The DME project will be carried out for 20 years. Foreign investment brought in from APCI in this project amounted to US$2.1 billion or equivalent to IDR30 trillion. Bukit Asam will supply 6 million tons coal for the DME project. In the future, this project can produce 1.4 million DME per year and reduce Indonesia's LPG imports by 1 million tons per year.